Are you in need of the 1099 NEC Form 2026 Printable? Look no further! This comprehensive guide will provide you with all the information you need to know about this essential tax form. Whether you are a freelancer, independent contractor, or small business owner, understanding the 1099 NEC Form 2026 is crucial for your tax compliance.

Knowledge

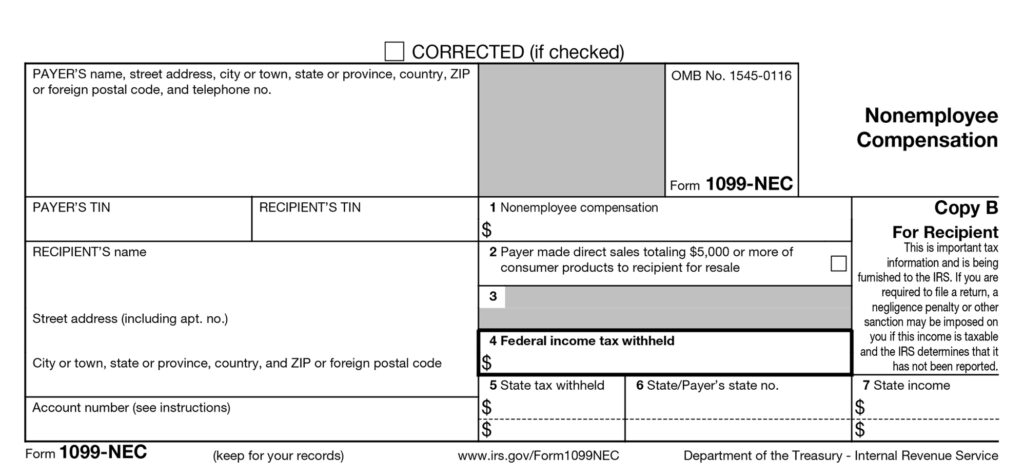

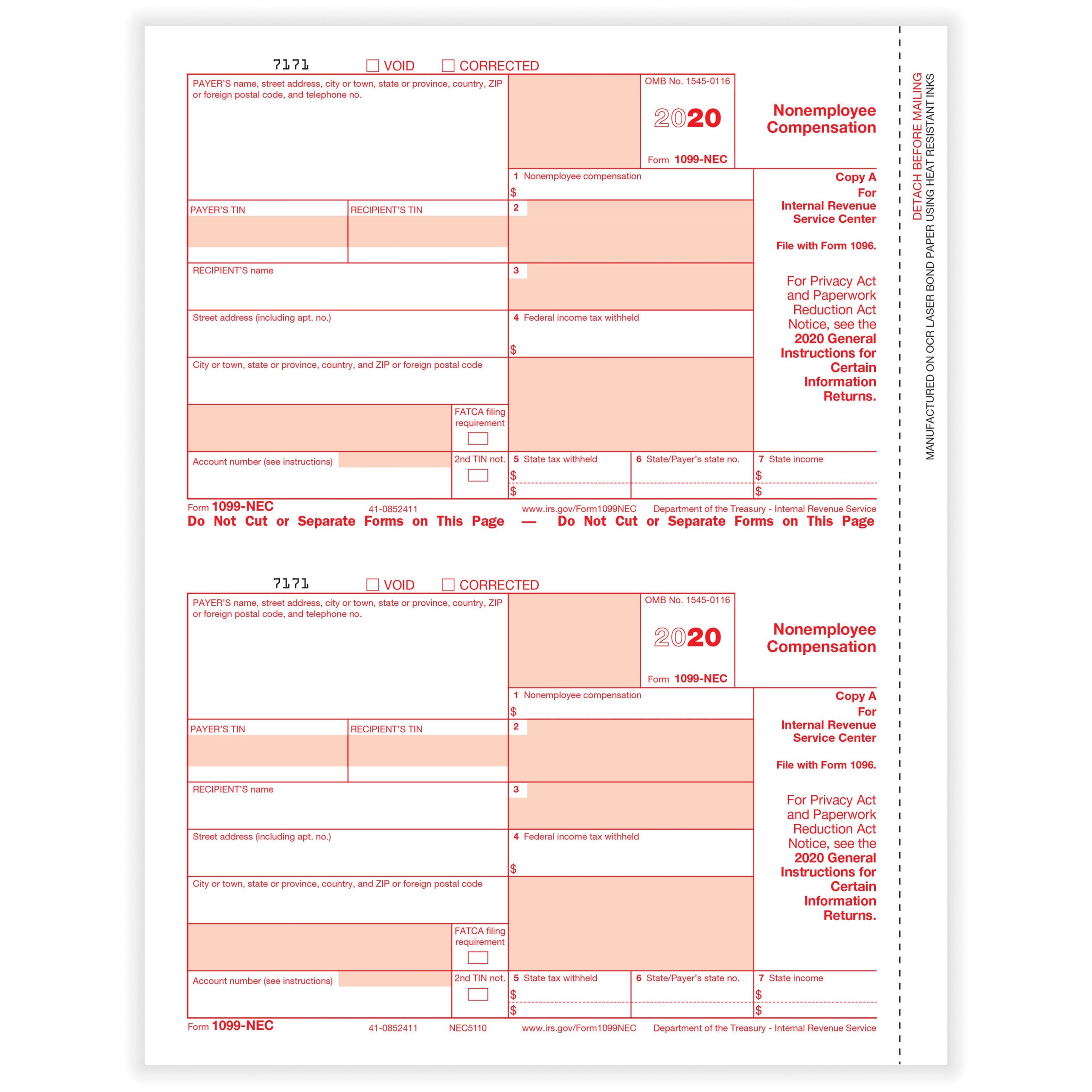

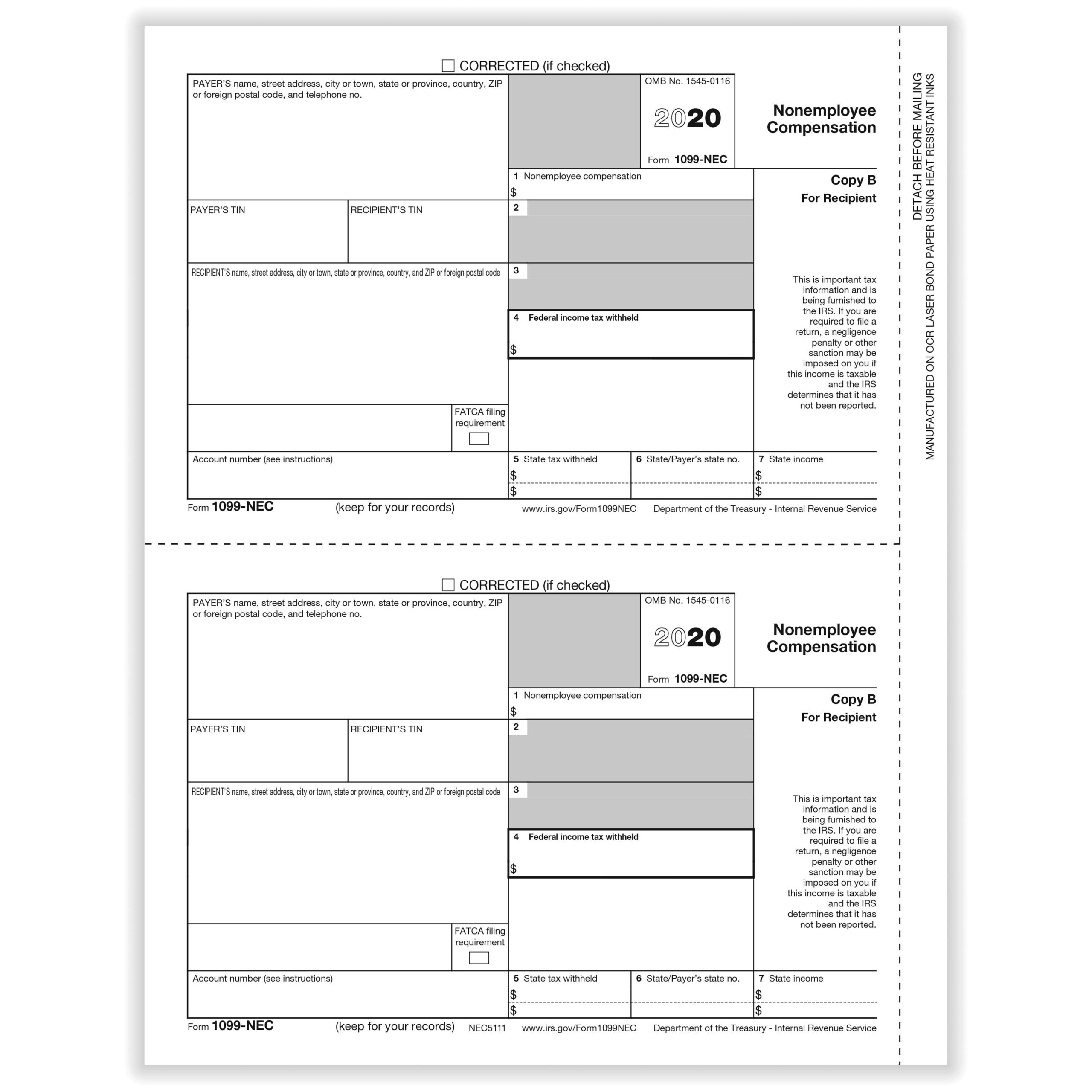

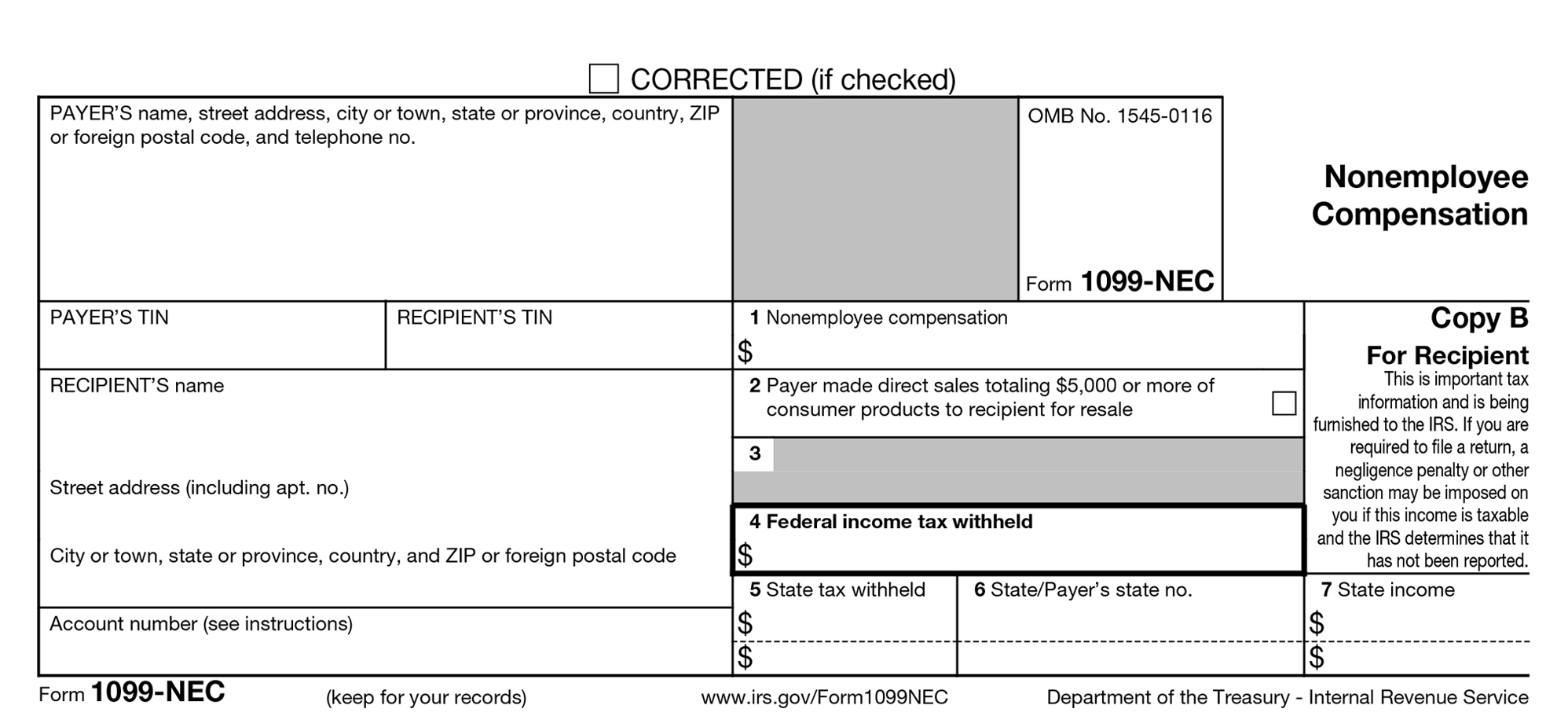

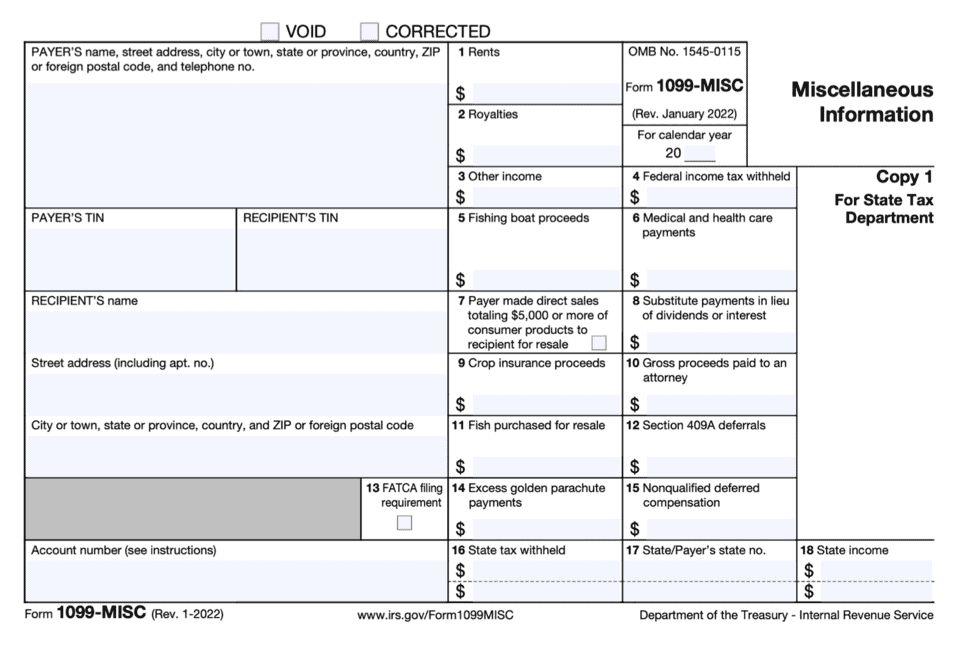

The 1099 NEC Form 2026 is used to report nonemployee compensation to the IRS. This form is essential for businesses that have paid $600 or more to a nonemployee for services rendered during the tax year. It is important to accurately fill out this form to avoid any penalties or fines from the IRS.

When filling out the 1099 NEC Form 2026, you will need to include the recipient’s name, address, and taxpayer identification number. You will also need to report the total amount of nonemployee compensation paid during the tax year. Make sure to carefully review the form for accuracy before submitting it to the IRS.

It is important to note that the deadline for submitting the 1099 NEC Form 2026 is January 31st of the following year. Failure to submit this form on time can result in penalties from the IRS. Make sure to keep accurate records of all payments made to nonemployees throughout the tax year to ensure timely and accurate reporting.

How to download and save it

Downloading and saving the 1099 NEC Form 2026 is easy. Simply visit the IRS website and search for the form by its number. You can then download the form as a PDF file and save it to your computer for easy access. Make sure to print out the form on official IRS-approved paper to ensure compliance with IRS regulations.

Once you have filled out the form with the necessary information, you can either mail it to the IRS or submit it electronically through their online portal. Be sure to keep a copy of the completed form for your records and provide a copy to the recipient as well.

Conclusion

In conclusion, the 1099 NEC Form 2026 is a vital document for reporting nonemployee compensation to the IRS. By understanding the requirements and deadlines associated with this form, you can ensure compliance with IRS regulations and avoid any potential penalties. This form is essential for freelancers, independent contractors, and small business owners who have paid nonemployees for services rendered.

Overall, the 1099 NEC Form 2026 Printable is a valuable tool for tax reporting and compliance. Make sure to familiarize yourself with this form and its requirements to stay on top of your tax obligations. Remember, accurate and timely reporting is key to avoiding any issues with the IRS.